Financing Your Outdoor Living Project: Payment Options to Consider

August 13th, 2023 | 5 min. read

Financing Your Outdoor Living Project

If you’re considering financing your outdoor living project, there are multiple options available. Which one is the best? It depends on factors like how much money you need to borrow, what improvements you’re making, and your risk tolerance.

At KP Contracting, we’re all about helping you actualize your outdoor living dreams. The key word is “your,” because there are as many types of outdoor living as there are homeowners. That’s true for payments, as well as outdoor living itself.

In this post, we’ll cover several types of financing for your home improvement project. You’ll get a better idea of which will work best for your situation.

Personal Loans for home improvement

Good if…

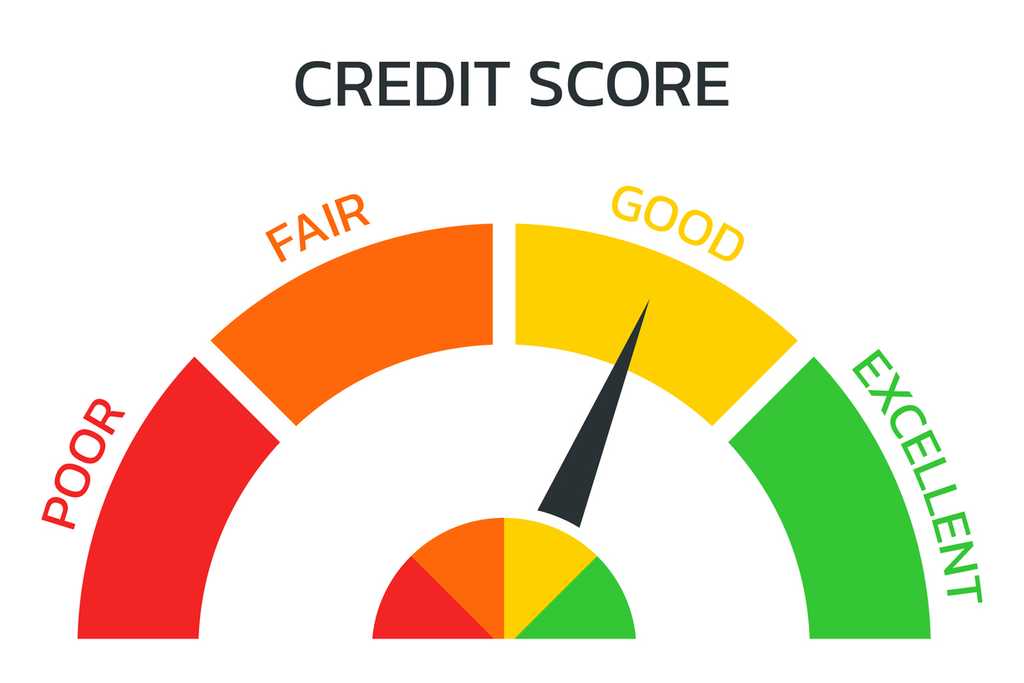

> you have excellent credit

> you don’t want to risk foreclosure

> you want easy access to the funds

> you want to avoid closing costs

> $100,000 or less is enough for your project

Not so good if…

> your credit score is on the low end

> you want to avoid higher interest rates

> you want tax benefits

> you want more time, or a more flexible timeline

If you have excellent credit, and want less worry on the back end, personal loans are a great choice. By excellent, that generally means 670 or above, though occasionally that number can go as low as 620. Lenders will also check your credit history, so if your account went to collection because of overdue library fines (it happens, don’t judge me), that might hurt your chances.

There are even lenders who specialize in home improvement loans, like HFS, Lyon, and Viking.

Personal loans aren’t for everyone, however. They lack the tax benefits that can come with home equity loans or HELOC loans (more on that below). The average interest rates, in the range of 10-12%, are pretty high.

Home Equity Loan

Good if…

> you know you’ll be able to repay the entire loan

> you plan to itemize on your taxes

> you want more time to repay a loan

> you need more than $100,000

> you want a lower interest rate than a personal loan

Not so good if…

> you’re unsure you can repay the loan (foreclosure risk)

> your project requires more money than 80% of your home’s value

> you want to start your project immediately (home equity loan approval can take weeks)

Foreclosure is the principal risk with a home equity loan. Even a single missed monthly payment could result in you losing your house. That’s not often the case, but if you struggle with money stress, that potential outcome may keep you up even later at night.

Home improvements are tax deductible if the home used as collateral is also the home you’re improving (I’m guessing this is most readers, given that only about 6% of people 30-49 own a second home). You can deduct interest on the loan up to $750,000 for joint filers, and up to $375,000 for single filers. As a heads up, this is only if you’re itemizing, rather than taking the standard deduction.

To be deductible, the money must have been spent to “substantially improve” the house for which the loan was taken. What constitutes “substantially improve?” Any improvements that “add value to the home, prolong its useful life or adapt it to new uses.” Fortunately, new decks fall under that rubric. However, minor cosmetic repairs don’t.

If you’re curious about whether you’d qualify for a home equity loan, you can try out one of these home equity loan calculators:

Home Equity Line Of Credit

Good if…

> you aren’t sure how much your project will cost

> your project is ongoing

> money accessible whenever you need it

> same tax deduction benefits as a home equity loan

> you don’t think you’d need the entire lump sum of a personal or home equity loan

Not so good if…

> you’ve struggled with credit cards in the past

> interest rates rise in general

> your credit score is low

> you have little equity in your house

A Home Equity Line of Credit is essentially a credit card where your home’s equity– rather than the bank’s money– acts as the line of credit. Since a HELOC acts like a credit card, it’s likely a good bet if you’ve had a good experience with credit cards.

A HELOC is a good bet if you aren’t sure how long your project will take, your project’s costs may change, or you need the flexibility offered by a line of credit.

One risk with a HELOC is that they usually have adjustable, instead of fixed, interest rates. That means if interest rates rise in general, you could be looking at higher payments. As with a home equity loan, your house secures the debt, so foreclosure is a possibility. A HELOC could also be a blow to your credit score, as it shows up as debt on your credit report.

Bank of America HELOC calculator

Cash-out refinance

Good if…

> you want to deduct the cost of home improvements

> you want a lower interest rate than personal, home equity, or HELOC

> you want payments spread out over a longer term than other loans

Not so good if…

> you don’t want closing costs

> you have a high debt-to-income ratio

> your credit score is on the lower end

In cash-out refinance, you essentially replace your current mortgage with a bigger one, then receive the difference between the two in cash. To qualify, you’ll generally need a credit score of at least 620, though some with a score as low as 580 have qualified. Other qualifications are a debt-to-income ratio of at least 43%, and at least 20% equity in your home.

Cash-out refinance is a good method if you need more money than a personal loan. If current mortgage rates are lower than when you got your first mortgage, you could actually wind up paying lower rates.

Credit Cards

Good if…

> you can find a card with a 0% APR intro period or other welcome bonuses

> your card offers rewards on home improvement purchases

> you have a credit card already, but have trouble getting a loan

Not so good if…

> you struggle with spending limits

> you’re using a pre-existing credit card

If you don’t want to bother with getting a loan, credit cards are another option for renovation finance. The name of the game here is the 0% APR introductory period. If you’re able to pay off your project during the intro period, you’ll be using the credit card well. If not, the credit card will be using you, as current credit card interest rates are in the 20-24% range. In general, 0% APR periods are 6 to 21 months.

Some home improvement retailers offer credit cards. Lowe’s and Home Depot both offer credit cards (though Home Depot’s can be used only at that store).

Credit cards will normally have much higher rates than personal or home equity loans, however. Unless you’re taking advantage of the introductory period, you’ll almost certainly wind up paying more.

Financing whatever project you’ve got in mind

Finding the right financing option is just one step on making your vision a reality. Whatever option works to pay for your project, we at KP Contracting are happy to help. We’ve got years of experience helping people with a range of funding options make their outdoor space homier and more inviting.

If you want to know how we can help you make your dreams a reality, give us a call at 240-266-5900, or reach out to us here. If you’re not quite to the financing stage, and want more prep before buying, check out our piece on 6 tips to find the right fit in a contractor.

Topics: